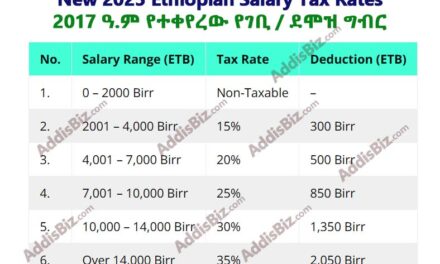

| No. | Salary Range (ETB) | Tax Rate | Deduction (ETB) |

| 1. | 0 – 2000 Birr | Non-Taxable | – |

| 2. | 2001 – 4,000 Birr | 15% | 300 Birr |

| 3. | 4,001 – 7,000 Birr | 20% | 500 Birr |

| 4. | 7,001 – 10,000 Birr | 25% | 850 Birr |

| 5. | 10,000 – 14,000 Birr | 30% | 1,350 Birr |

| 6. | Over 14,000 Birr | 35% | 2,050 Birr |

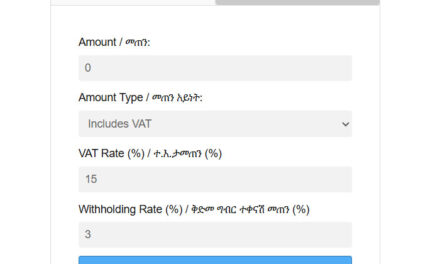

Easily estimate your net salary using our Ethiopian Salary Tax Calculator. Based on the new and old Ethiopian income tax rate tables, this tool helps you calculate income tax, pension, cost sharing, and net pay. Whether you’re an employee or HR professional, use this calculator to understand the Ethiopia payroll calculation formula for both new and previous tax rates.