| No. | Salary Range (ETB) | Tax Rate | Deduction (ETB) |

| 1. | 0 – 2000 Birr | Non-Taxable | – |

| 2. | 2001 – 4,000 Birr | 15% | 300 Birr |

| 3. | 4,001 – 7,000 Birr | 20% | 500 Birr |

| 4. | 7,001 – 10,000 Birr | 25% | 850 Birr |

| 5. | 10,000 – 14,000 Birr | 30% | 1,350 Birr |

| 6. | Over 14,000 Birr | 35% | 2,050 Birr |

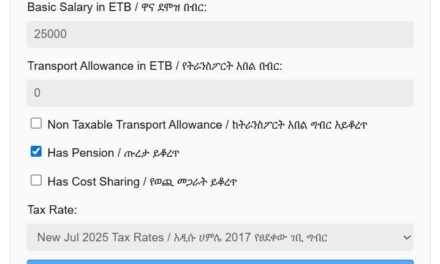

Ethiopian Salary / Payroll Tax Calculation Formula

Salary Income Tax = (Gross Salary * Tax Rate) – Deduction

Employee Pension – Gross Salary x 7%

Net Income = Gross Salary – Salary Income Tax – Employee Pension – Other Taxes (If applicable)

Employee Pension – 7%

Company Pension – 11%