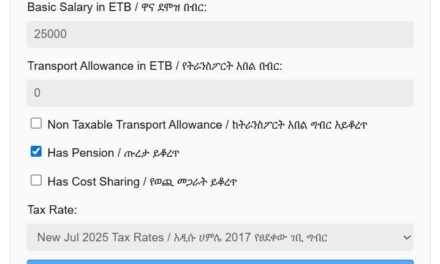

2025 UPDATE – Ethiopian Salary Tax Calculator for New 2025 (2017 E.C) Tax Rates

Here are the formulas on how to calculate personal (employee) income tax, pension, gross and net income in Ethiopia.

Salary Income Tax = (Gross Salary * Tax Rate) – Deduction

Employee Pension – Gross Salary x 7%

Net Income = Gross Salary – Salary Income Tax – Employee Pension – Other Taxes (If applicable)

Employee Pension – 7%

Company Pension – 11%

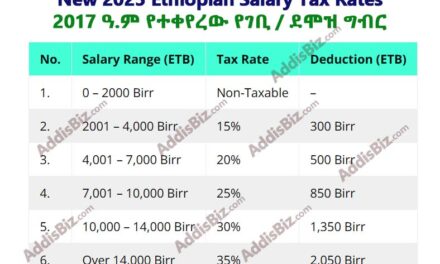

| No. | Salary Range (ETB) | Tax Rate | Deduction (ETB) |

| 1. | 0 – 600 Birr | Non-Taxable | – |

| 2. | 601-1,650 Birr | 10% | 60 Birr |

| 3. | 1,651 – 3,200 Birr | 15% | 142.50 Birr |

| 4. | 3,201 – 5,250 Birr | 20% | 302.50 Birr |

| 5. | 5,251 – 7,800 Birr | 25% | 565 Birr |

| 6. | 7,801 – 10,900 Birr | 30% | 955 Birr |

| 7. | Over 10,900 Birr | 35% | 1,500 Birr |

Sample Calculation

If the salary of an employee is 2,000 Birr.

If the salary of an employee is 2,000 Birr.

By referring to the above table, we can see that 2,000 birr falls in the No. 4 row. So, Tax Rate = 15% and deduction = 142.50

Income Tax = (2,000 Birr x 15%) – 142.50 Birr

Income Tax = 300 Birr – 142.50 = 157.50 Birr

Employee Pension = 2,000 Birr x 7% = 140 Birr

Employee Net Income = 2,000 Birr – 157.50 – 140 = 1702.50 Birr

Net Income = 1,702.50 Birr

Dear Thank you !!

How to calculate the deuction eg 60 142.5 etc

(60,142.50*35%)-1,500=19,549.875

How to calculate back payment

How to calculate income tax the basic salary=2800 and transportation allowance=900?

You can download Engocha marketplace app from the play store. It has a salary calculator.

how to calculate deduction for each tax rate

2800*1/4=700

transportation all 900-700=200

2800+200=3000

3000*15%-142.5=307.5

what is the calculation of severance