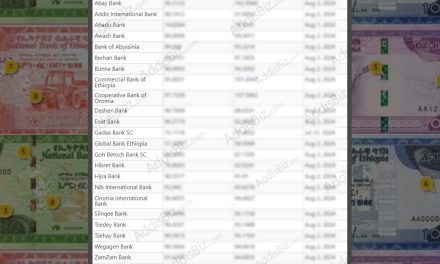

Bunna International Bank has reported that it has earned a profit before tax amounting 582 million birr, making the net profit 440.29 million birr. This is the first time the company’s profit declined in it’s 11 years of operation. The earning per share (EPS) of the bank decrease from 28.69 to 22.50.

During the annual shareholders meeting held on Sunday, December 20th, 2020 at Golf Club in Addis Ababa, the Bank announced that it mobilized a total of 13.88 billion birr in deposit which is 3.29 billion or 31.06% higher than the previous year. Total outstanding loans and advances of the Bank have reached 11.57 billion birr at the end of 2020/2019 budget year increasing by Birr 3.29 billion birr or 40% from last year’s performance.

The Bank has managed to mobilize a total foreign currency amount of USD 159.6 million during 2020/2019 F.Y. Looking at the sources of the Foreign Currency, Export proceeds take the lion’s share with 70%, followed by incoming transfer by 18%, public procurement 11.3% and the remaining share was that of cash purchase and foreign exchange trade.

The quality of the loan portfolio as expressed in terms of NPL ratio reached 4.64% during the year under review lower than the maximum threshold set by the National Bank of Ethiopia (i.e. 5%).

Total revenue of Birr 2.17 billion was generated during 2020/2019 f.y which is an increase of Birr 341.24 million or 18.62% compared to the previous year. During the period under review, the Bank incurred a total operating expense of Birr 1.59 billion. This figure was higher than that of last year same period by Birr 384.23 million (31.82%).

The total number of deposit account holders reached 809,493 as of June 30, 2020, indicating the annual recruitment of 268,070 new customers.

The total asset of the Bank reached Birr 18.87 billion as of June 30, 2020, which is higher by Birr 4.37 billion (30.17%) compared to the previous year. The total capital of the Bank has reached 3.07 Billion Birr, increasing by Birr 503.80 million Birr compared to last year’s amount of Birr 2.57 Billion Birr. The Paid Up Capital at the end of the annual period stood at Birr 2.17 billion, showing an increment of Birr 396.46 million or 22.38%.

BIB has managed to open 37 branches (12 in Addis Ababa and 25 Outlying). Therefore, the total number of branches as of June 30, 2020, reached 242; of which 130 branches (54%) are located outside Addis Ababa while the remaining 112 (46%) are in Addis Ababa.

Trackbacks/Pingbacks