Dashen Bank posted four percent growth in net profits to 756.1 million Br, while its shareholders’ return has been plummeting for five years in a row to 392 Br, almost 70 Br higher than the industry average.

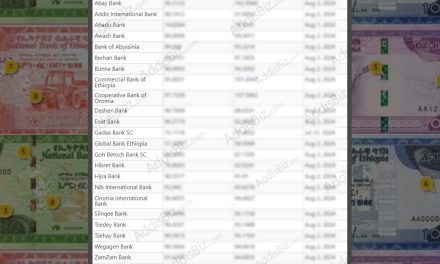

The 22-year old Bank was optimistic about its latest performance as it reported the second highest profit amongst all 16 private banks in the country, next to its nearest competitor Awash Bank, whose earnings per share (EPS) stood at 409 Br last year.

The amount that goes into the pockets of Dashen’s shareholders has been declining year-on-year. Its EPS in the past year was half of what it registered in 2012, owing to the stagnant profit growth coupled with a surge in capital.

“Unless the management of Dashen devises strategies to increase profit after tax or slows down capital growth, further decline is inevitable,” said Abdulmenan Mohammed, a financial expert with 15 years of experience in UK and Ethiopia.

The Bank’s management attributed the economic slowdown, competition in the banking industry and the central bank’s tight regulations for the performance.

“The underperformance of the export sector and stiff competition in the banking industry affected our profit growth,” said Mulugeta Alebachew, Marketing & Corporate Communications director of Dashen. “Massive expansion strategy and upsurge in paid-up capital resulted in a decrease in shareholders’ returns.”

Despite the steady profit growth, Dashen, which has managed to raise its paid-up capital by 29pc to almost two billion Birr, generated total revenues of 3.4 billion Br in the past fiscal year, showing a 25pc growth compared to 2015/16.

Its income statement reveals that the Bank reported mixed results in income generating activities. Its interest in loans, advances, NBE bills and other deposits increased by 35pc to 2.3 billion Br, while service charges, commissions and other revenues have also gone up by 14.5pc to 838.2 million Br.

Nevertheless, gains on foreign exchange dealings dropped by seven percent to 266.5 million Br. For three consecutive years now, the Bank has registered such decline, almost two folds lower than its nearest competitor Wegagen and 1.6 million Br lower than Awash ’s.

“Stiff competition in remittances and card banking services and moderate performance in exports have had implications on the Bank’s foreign exchange earnings,” said Asfaw Alemu, president of Dashen. “This has impacted its relationship with customers and overall operations.”

The forex crunch has been at its peak over the past half-decade resulting in the shutdown of businesses and affecting profits of financial institutions.

It was primarily due to stagnant export earnings, three billion dollars for half a decade, and remittance flow that eventually resulted in the devaluation of the currency three months ago.

An expansion in expenses exacerbated the slow growth in income generating activities.

Interest paid on deposits has increased by 24pc to 921.26 million Br, Salaries and benefits have soared by 39pc to 788.48 million Br and general administration expenses have gone up by 34pc to 593.93 million Br.

Likewise, the provisions set aside by the Bank for doubtful debts surged by three and a half folds to 131.6 million Br. It is higher than the amount held for six years since 2010, consuming the revenues from financial intermediation and other operations of the Bank.

“We had difficulty in collecting loans from customers dependent on the tourism industry, which was affected by the unrest in some parts of the country,” said Mulugeta. “As it is a provision, we are positive that it will be collected this year.”

Despite being affected by the unrest in the country last fiscal year, Dashen was effective in mobilising resources compared to 2015/16, collecting deposits of 27.7 billion Br, a 22pc increase.

The growth in deposits was accompanied by a massive expansion in loans and advances, disbursing 17.7 billion Br, an increase of 42pc from the preceding fiscal year.

Such improvements have helped the Bank raise the share of a loan in total deposits from 55pc to 64pc. This amount, albeit, is three percentage points lower than the industry’s average, indicating additional earnings from its liquid resources.

Source : AddisFortune