Abay Bank which held it’s 13th Ordinary & 7th Extraordinary Annual Shareholders’ General Assembly on November 19, 2022, at Inter Luxury Hotel, reported that the company has earned 1.3 billion birr and 933.26 million birr in profit before and after tax respectively. The company’s earning per share (EPS) decreased from 333.5 for the previous year to 295 for the current year.

In her speech, Ethiopia Tadesse, the Bank’s Board Chairperson, addressed that though the rise of the Omicron variant, the Russia-Ukraine and North Ethiopian conflict has directly influenced the economic situations in the country, the Bank has accomplished a commendable performance in all performance parameters.

Yehuala Gessesse, Chief Executive Officer of the Bank, on his part said, the Bank generated Birr 4.4 billion revenue, raise its branch networks to 373 and grow the customer base close to 1.7 million during the 2021/22 budget year.

As of June 30, 2022, the Bank’s total deposit stood at Birr 32.4 billion, exhibiting a growth of 35% against its preceding year’s record, out of which Birr 1.6 billion is mobilized through Abay Sadiiq IFB services. During the year alone, additional deposits of Birr 8.5 billion was mobilized from both conventional and IFB sources registering respective growths of 36% and 28%. The Bank has recruited more than 470,372 new customers of conventional and IFB services in the fiscal year attaining annual growth of 39% to reach 1,671,691 customers of deposit in aggregate.

The Bank’s outstanding loan advanced to customers to date amounted to Birr 27 billion of which Birr 26.3 billion was conventional while the remaining Birr 716 million was provided to the Bank’s Interest free banking customers. The feat witnesses a 34% growth put against last year’s corresponding period record. Regarding the composition of Loans and Advances, International Trade once again takes up the largest proportion (45%) followed by Domestic Trade and Services (17%). Loans availed to Building and Construction sector accounted for 15% of the total loan balance whereas Manufacturing and Other sectors shared 8% each. Transport and Communication claimed the rest 7% share.

Registering growth of 30% from the previous year, the Bank generated a total income of Birr 4.4 billion 80% of which is claimed by interest income. On the other hand, 14% and 6%, respectively, of the total income were raised from Commissions and Service fees and Other income sources. The total expense of the Bank during the financial year under review reached Birr 3.1 billion, growing by 39% compared to last year’s corresponding record. The two expense categories of Salary and benefits and, Interest expenses grew by 57% and 40%, respectively, from the previous year corresponding spending while General expenses rose by 27% year-on-year.

The total asset of the Bank reached Birr 40.7 billion as at the year just ended exceeding the balance as of last year’s corresponding record by Birr 10.8 billion, registering a growth of 36%. The growth in loans and advances had been instrumental to the spelled growth in the Bank’s total asset.

As of June 30, 2022, the Bank’s total equity reached Birr 5.9 billion exceeding last year’s same period balance by 39%. Paid-up capital of the Bank has reached Birr 3.97 billion recording a 41% growth from its previous year record thanks to the injection of Birr 1.16 billion additional capital by the Bank’s shareholders.

Abay Bank expanded its branch network in different parts of the country by opening eighty-seven additional branches out of which six of them were opened to serve primarily the Bank’s Abay-Saadiq customers. The remaining 81 new branches serve conventional as well as IFB customers using IFB serving windows. Consequently, the total number of branches reached 373, out of which 12 are fully dedicated to Interest Free Banking services, at the close of the financial year attaining a 30% growth against last year’s corresponding record.

Abay Bank has created employment opportunity to 1,683 new employees during the year and the total headcount reached 6,990 of which, 3,608 are permanent while 3,382 are outsourced employees. The Bank has installed 76 additional ATMs at various branches and marketable locations. As a result the number of functional ATM aggregated to 161. Exceeding records of the previous year significantly, the number of new subscribers for the year grew by more than 345, 000 and 157,000, respectively, of Card and Mobile Banking platforms. Consequently, the total number of Mobile and Card Banking subscribers has reached 648,290 and 430,705 in that order.

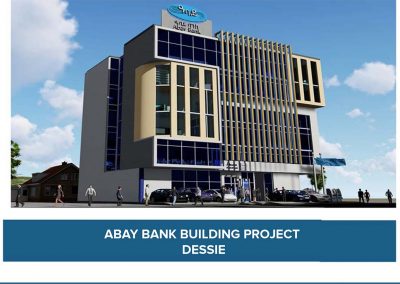

The Bank has undertaken construction activities in the capital Addis, Dessie and Bahir Dar.